SoFi Shares Plunge 13% on Planned Stock Sale

Announcement of Planned Stock Sale Triggers Market Selloff

Investors React Negatively to Dilution News

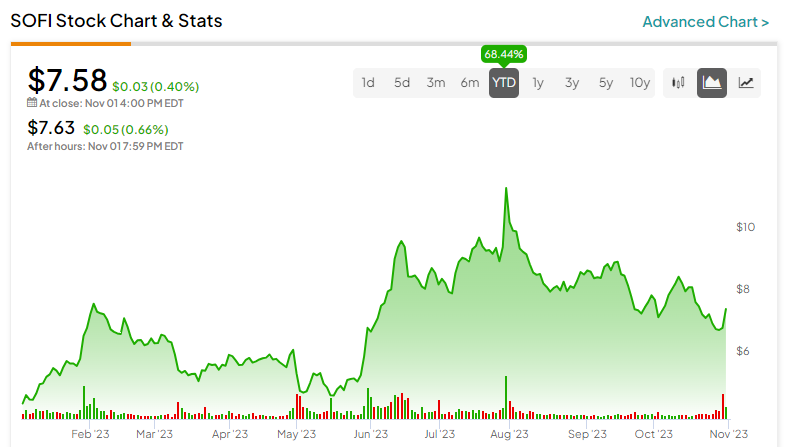

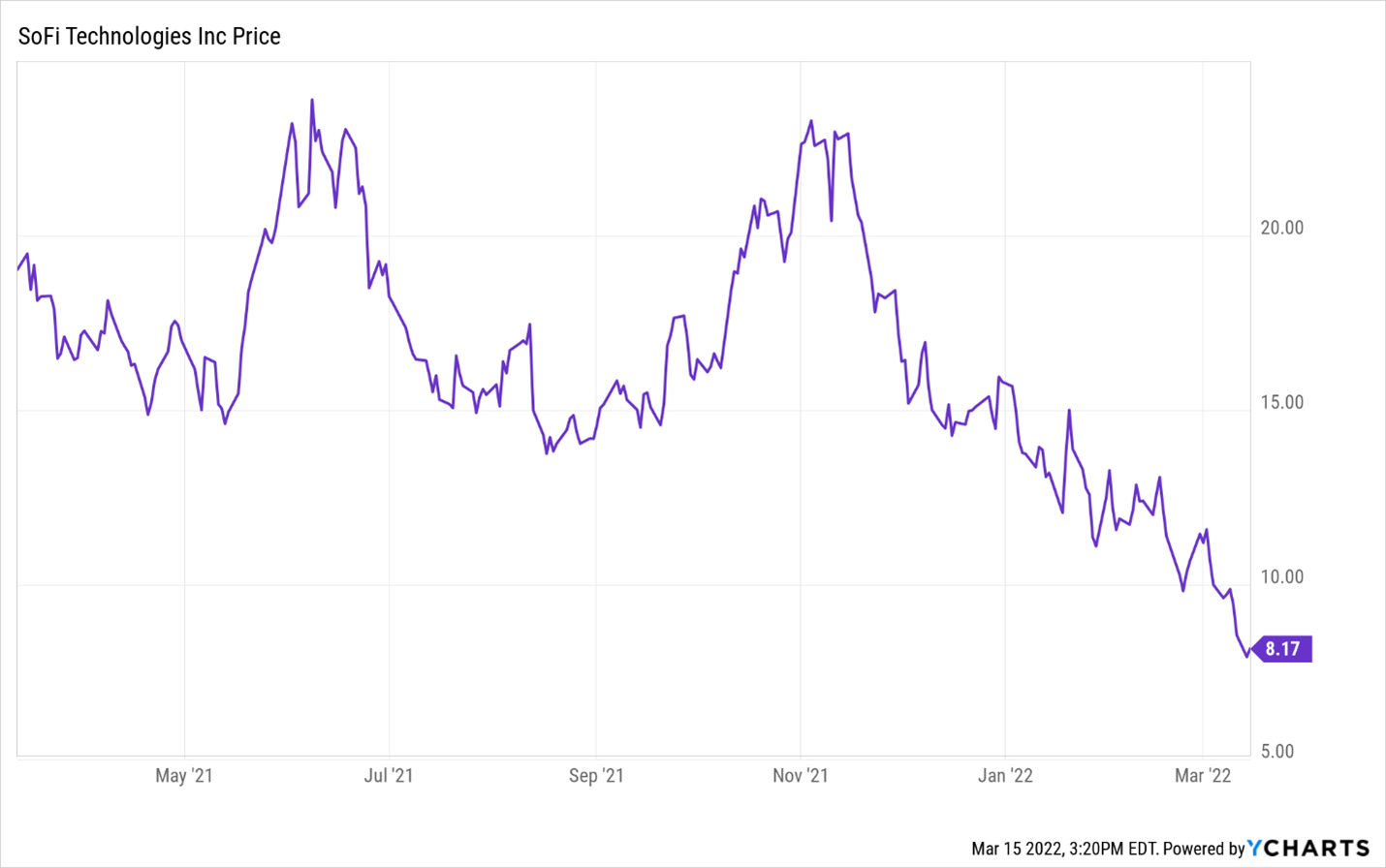

Shares of SoFi Technologies (SOFI) tumbled 13% on Tuesday in response to the company's announcement that it plans to sell up to $862.5 million in stock. The move represents a significant dilution for existing shareholders, who are concerned about the potential impact on the company's earnings per share and overall valuation.

SoFi, an online financial services provider, said the proceeds from the stock sale will be used for general corporate purposes, including investing in its technology platform and expanding its product offerings. However, investors are wary of the dilutive effect the additional shares will have on their ownership stakes and potential returns.

Analysts note that SoFi's decision to sell stock now raises questions about the company's financial position and growth prospects. They believe the stock sale could indicate that SoFi is struggling to generate sufficient revenue and profitability on its own and may need external funding to sustain its operations.

The market's negative reaction to the stock sale announcement highlights the importance of investor confidence in a company's long-term plans. SoFi will need to provide more details about its growth strategy and how the proceeds from the stock sale will be used to regain investor trust and prevent further share price declines.

Comments